Difference between revisions of "Stichting Pensioenfonds ABP"

AidenCorreia (talk | contribs) |

AidenCorreia (talk | contribs) |

||

| Line 250: | Line 250: | ||

== Climate Policy and Plans == | == Climate Policy and Plans == | ||

==== 2015 to 2020 ==== | ==== 2015 to 2020 ==== | ||

Revision as of 16:16, 12 April 2022

| Stichting Pensioenfonds ABP | |

|---|---|

| |

| Quick Facts | |

| Type | Public pension fund |

| sector | Financial Services |

| Headquarters (Benelux Organization) | Heerlen, The Netherlands |

| Year of Origin | 1922 |

| Emissions (All Scopes) | 21.35 Megatons of CO2 (2020)[1] |

| Total Revenue | EUR€ 528 billion (2020)[2] |

| Stock Exchange | None |

| Key People | Harmen van Wijnen (Chairman Executive Board), Yolanda Verdonk-van Lokven (Executive Board Member); Dominique Dijkhuis (Executive Board Member) |

| Number of Employees | 41 (in 2020) |

| Subsidiaries | Algemene Pensioen Groep (APG)

|

Stichting Algemeen Burgerlijk Pensioen, stylized as Pensioenfonds ABP, is the largest pension fund in the Netherlands, and among the top three worldwide.[3] Its headquarters is placed in Heerlen, a city in Limburg.[4] ABP offers all types of pensions, such as a Disability Pension, a Partner's Pension, and a Retirement Pension. The pension fund was established in 1922 primarily to regulate the pensions of Dutch civil servants and teachers. At the time it was government controlled, but in 1996, ABP was privatized.[5] In 2020, the fund served over 3.1 million employees, and an additional 3,557 employers. The pension fund itself only had 41 employers as of 2020,[6] but its executive subsidiary APG has over 3,124 employers in the Netherlands and another 246 abroad.[7] Although ABP predominantly provides pensions to Dutch citizens, the company invests worldwide.[8] On February 28th, 2022, ABP confirmed that their current assets are worth 528 billion EUR.[9] Their liabilities account for 475 billion EUR.[10]

Company Structure

As of January 1st 2022, ABP has a new management model.[11] It now consists of three executive members, twelve non-executive members, and one independent chairperson. The executive members are responsible for the daily management such as decision making and implementation. The non-executive members have a supervision role. They are appointed by employees, employer-organizations or retirees. The board is led by an independent chairman.[12]

Since the institution was originally established by the Dutch government, its headquarter is in the Netherlands. In 1960 they moved the office from The Hague to Heerlen, to compensate for the closure of the national mines in the south.[13]

Furthermore, ABP has outsourced the pension administration and management of invested capital to APG.

Executive Board

| Name | Function | Remuneration x1000 EUR |

|---|---|---|

| Harmen van Wijnen | Chairman Executive Board | 130,637 EUR (2020)[14] |

| Yolanda Verdonk | Executive Board member | Unknown |

| Dominique Dijkhuis | Executive Board member | Unknown |

According to the 2020 annual report, this is what H. Wijnen would make from 01-05-2020 onwards. However, as there is no annual report available of 2021 nor 2022, it is uncertain whether his salary has stayed the same. Similarly, there is no telling what the remunerations are for the other board members, as they have only recently been appointed (Y. Verdonk in 02/2022 and D. Dijkhuis in 01/2022). Additionally, ABP has completely transformed their management model. However, the salaries will not be able to be higher than €200,000 due to the Wet Normering Topinkomens (The Top Income Standard Law).[15]

ABP does state in a 2019 position paper that they strive to keep the managament wages in line with the wages received by their clients.[16] This means that the salaries will grow in the same degree as those of teachers and civil servants. However, ABP does grant performance bonuses to its directors. In addition to that, it allows its subsidiary APG to pay out high bonuses to those employed on the asset management department. On top of that, wages amongst those working at APG are significantly higher. In 2020 Annette Mosman (CEO) made €520,070 and Ronald Wuijster (head of the APG Asset Management) made €748,865.[17]

Supervisory Board

| Name | Function | Remuneration x1000 EUR (2020)[18] |

|---|---|---|

| Corien M. Wortmann-Kool | Chair Supervisory board | 130 EUR |

| Aldert Boonen | Member supervisory board | Unknown |

| Patrick Fey | Member supervisory board | 90 EUR |

| Anne Gram | Member supervisory board | Unknown |

| André van Vliet | Member supervisory board | 95,75 EUR |

| Krista Nauta | Member supervisory board | 90 EUR |

| Paul Rosenmöller | Member supervisory board | Unknown |

| Loek Sibbing | Member supervisory board | 90 EUR |

| Vandena van der Meer-Gangapersadsing | Member supervisory board | Unknown |

| Conchita Mulder-Volkers | Member supervisory board | 90 EUR |

| Xander den Uyl | Member supervisory board | 90 EUR |

The reason the salaries and additional benefits of some of the supervisory board members are unknown, is because they did not begin working at ABP until or after 2021.

It is unclear what the renumerations will amount to as of 2022, taking into consideration that they restructured their board management.

Accountant

The independent auditor of Pensioenfonds ABP is KPMG Advisory N.V. They have been ABP's accountant since January 1st 2016.[19]

Main Activities

As ABP is a pension fund, it functions on the basis of capital funding. This entails that an employee, alongside their employer, accrues pension entitlements. These are put into a pension fund, in this case ABP, who then invests these contributions into different establishments, companies, and stocks. Over time, the pension fund increases the amount of capital they initially started out with, so that by the time someone goes into retirement, the pension they receive is more than what they deposited as pension entitlements. In the Netherlands, the pension system features “collectivity, mandatory participation, efficient administration and [it] is not-for-profit".[20] Because of this, it is beneficial for clients that ABP manages to expand their capital over the years and invests wisely. This especially since over 3.1 million Dutch citizens are affiliated to ABP.

At the start of 2022, their expected liabilities were €475 billion. This is the value of the pensions which ABP must pay out now and in the future. Meanwhile their available assets (investment endeavors) were worth €528 billion. This means that, were every Dutch civil servant and teacher to suddenly retire, ABP would have the sufficient funds to cover all of the pensions, and then they would have an additional €53 billion left. At the time, their coverage ratio was 111.0%.[21]

ABP has an incredibly diversified investing portfolio. At the end of 2021, they had invested a total of €551,614 million in thirteen types of categories. These range from basic materials, to energy, to financial institutions. ABP invests most in other financial institutions (25.04%), public authorities (23.46%), and information technology (10.72%).[22] They invested slighty more than €16 billion EUR in the energy sector. ABP invests worldwide, but predominantly seems to focus on North America (37.61%) and the European Monetary Union (34.31%).[23]

According to their overview of the holdings of ABP as per December 31st 2021, ABP has invested in some 867 companies worldwide.[24] 35 of these are amongst the top 100 most polluting companies worldwide.[25] In total, they invested about 1,499 million EUR in these 35 companies alone.[26]

Government

ABP has been privatized since 1996 which means that the government is no longer in charge of how the pension fund invests its money. Prior to this, ABP’s investment freedom was curtailed by the Dutch government. For instance, they were not allowed to engage in foreign investment. Nor could they own more than 5 percent of any one company. Additionally, they had to invest all government contributions in government debt.[27]

These restrictions have since been lifted, and ABP is free to invest wherever they like. They do continue to invest a lot in government bonds.[28]

ABP does not receive NOW support nor has it attained a royal status. However, it is in the government’s interest that ABP acts in the common interest of the public. This because the accrual of ABP’s pension fund is tax-facilitated, which results in less tax money flowing into the governmental treasury. So, Pensioenfonds ABP has to act with integrity, efficiently, trustworthiness, and transparency.[29]

Paris Agreement until Today

What has the company done or refused to do since the Climate Accord of Paris? Per company, where applicable refer to research on the benefits of fossil companies in the form of subisidies etc.

Financial Results since 2015

This tabel is meant to indicate that the companies have plenty of money to make their company more sustainable. Clearly distinguish between Dutch data and international data.

| Year | Revenue | Profit | Dividend |

|---|---|---|---|

| 2015 | XXX Billion EUR | XXX EUR | XXX EUR |

| 2016 | XXX Billion EUR | XXX EUR | XXX EUR |

| 2017 | XXX Billion EUR | XXX EUR | XXX EUR |

| 2018 | XXX Billion EUR | XXX EUR | XXX EUR |

| 2019 | XXX Billion EUR | XXX EUR | XXX EUR |

| 2020 | XXX Billion EUR | XXX EUR | XXX EUR |

| 2021 | XXX Billion EUR | XXX EUR | XXX EUR |

Scandals and controversies

Menno Snel

Whilst being a board member of ABP, Menno Snel was simulatenously appointed chairman for the Nogepa, the Dutch association for oil and gas exploration and production.[30]

Animal welfare

According to Funding destruction of the Amazon and the Cerrado-savannah (2020) ABP has invested 580 million EUR in companies which are either directly or indirectly connected to deforistation in the Amazon and the Cerrado-savannah.

Human rights

According to Pension funds and land grab - an inconvenient truth (2021), ABP appears to invest 3.7 billion EUR in 22 companies that are involved in land rights violations.

Climate change

According to Fossil fuel versus renewable financing by financial institutions active in the Netherlands (2021) ABP was by far and large the biggest investors in fossil energy.

Additionally, Climate change commitments of financial institutions active in the Netherlands (2021), ABP is also lacking when it comes to eradicating the presence of oil and gas from their investment portfolio.

Current Emissions

According to ABP itself, the CO2-emmissions from all of their investments account to 21,355,163 CO2e in total. When looking at their assets, state obligations and private equity, ABP exclusively takes scope 1 and scope 2 (the direct and indirect amount of emissions of a company's own activities) into consideration. The only sector for which they look into scope 3 (the emissions of the entire supply chain) is the real estate market. The reason behind this informational gap is that according to them "data on scope 3 emissions are not trustworthy enough yet and it would lead to double counting".[31] Because they retrieve their data from independent instances, such as GRESB for the real estate market, ABP is unable to provide specificities on the amount of scope 3 emissions in this sector.

When looking at data provided by APG, ABP's subsidiary, the rate of CO2-emissions seems to be slightly higher. They report a total of 24,852,626 CO2e.[32]

Section draft: expand on the importance of including scope 3 data

Climate Policy and Plans

2015 to 2020

In response to the Paris Climate Agreement, ABP published a Sustainable and Responsible Investment 2015 report. Here they argued that they would strive to become a sustainable pension fund. By drawing onto the idea that “returns and sustainability go hand in hand”[33] ABP pledged to focus on responsible investments. In collaboration with their investment organization APG they strived to solely invest in companies setting good examples, and exert their influence on incentivizing companies to improve.

Some of the clear goals they set themselves were i) cut their CO2 footprint of their equities portfolio by 25% between 2016 and 2020; ii) increase their investment in renewable energy to €5 billion; iii) double their investment in solutions to social and environmental problems to €58 billion by 2020; and lastly iv) invest an additional €1 billion by 2020 in their participants’ areas of involvement: education and communications infrastructure.[34] They gave themselves until 2020 to introduce these new policies. So, have they?

By the end of 2019, ABP had reduced the CO2 footprint of their equities by more than 25 percent. Indeed, they had managed to reduce it by 37 percent.[35] However, important to take into consideration here is the effect that the COVID pandemic had on polluting sectors such as energy and industry. As a response, ABP’s portfolio managers naturally invested less in these sectors, hence sharply reducing their CO2 footprint. It is unclear if the portfolio managers would have made the same choices if it hadn’t been for the economic turmoil following the COVID outbreak.

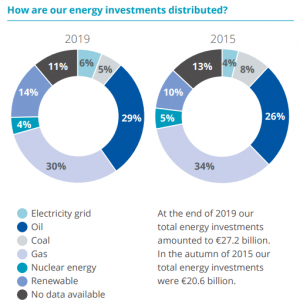

ABP did increase their investment in renewable energy with a total of €6.5 billion.[37] Part of this money has gone to Merkur Offshore, a large wind farm situated in the German sector of the North Sea. ABP states that these wind turbines save around 480,000 metric tons of CO2 emissions. They have also invested in the Dutch wind farm Goeree-Overflakkee.[38] They do however continue to invest in energy company Engie whose subsidiary owns nuclear power plants. According to the opposition, nuclear energy is costly, inefficient, too slow, and potentially dangerous.[39] Although ABP has begun to invest more in renewable energy, they did continue to invest relatively more in gas and oil (Image 1).

ABP has managed to double their investment in solutions to social and environmental problems. In total, the pension fund has invested 65.6 billion in companies that contribute to the Sustainable Development Goals (SDGs).[40] These companies are referred to as Sustainable Development Investments (SDIs). These companies must meet ABP’s criteria for return, risk and costs. The largest share of the SDIs is real estate. A total of €24 billion has been invested in sustainable real estate to meet the demands of SDG 11 - Sustainable cities and communities. These companies qualify as an SDI if it receives either four of five out of five stars on the annual sustainability survey of the Global Real Estate Sustainability Benchmark (GRESB).[41] Additional to this, ABP has expanded its green bond portfolio and currently invests a total of €7,601 million in green bonds.[42]

2020 and beyond

At the end of 2020 they published a new Sustainable and Responsible Investment Policy.[43]

Draft: expand on their plans starting 2020.[44]

They are also part of Climate Action 100+ (CA100+), an investor-led collaboration that attempts to pressure companies in reducing their CO2 levels by rewarding them financially. Despite good intentions, CA100+ has as of now failed to push any of its 159 focus companies forward.[45]

Starting 2021, ABP has officially stopped investing in fossil fuels.[46]

On top of that, ABP will also sell all of their assets in coal producers.[47]

Due Diligence

Keep the broader context in mind. Is the company integer when it comes to deforestation, palm oil, biodiversity, human rights etc etc? Be critical in the sources used here.

Conclusion

Recap of the position and influence of the company. Are the climate plans of the company enough to be in line with goals of the Paris Agreement? Is the company doing enough? Are the companies targets realistic?

References

- ↑ ABP. Meten en sturen op de CO2-voetafdruk van onze beleggingen, p. 2, retrieved on April 12th 2022. https://www.abp.nl/images/ABP%20CO2%20methodologie_3.pdf

- ↑ ABP. Financial situation on February 28th 2022, retrieved on April 6th 2022. https://www.abp.nl/english/financial-situation/financial-dashboard.aspx

- ↑ Kennisbank ABPpensioen. De positie van pensioenfonds ABP, retrieved on April 6th 2022. https://abppensioen.nl/het-fundament-van-pensioenfonds-abp/

- ↑ ABP. Contact Us, retrieved on April 6th 2022. https://www.abp.nl/english/contact-us.aspx

- ↑ II May 1996 Archive. Can ABP Cope With Freedom?, retrieved on April 6th 2022. https://www.institutionalinvestor.com/article/b14zpmqlqfsjrm/from-the-archive-can-abp-cope-with-freedom-may-1996

- ↑ ABP Annual Report 2020, p. 5, retrieved on April 6th 2022. https://jaarverslag.abp.nl/abp-jaarverslag-2020.pdf

- ↑ APG Annual Report 2021, p. 125, retrieved on April 6th 2022. https://jaarverslag.apg.nl/docs/APG_JV_2021/pdfs/APG_Groep_NV_Jaarverslag_2021.pdf

- ↑ ABP. Overview Corporate Bonds ABP as per December 31, 2021, retrieved on April 6th 2022. https://www.abp.nl/images/overview-corporate-bonds.pdf

- ↑ ABP. Financial situation on February 28th 2022, retrieved on April 6th 2022. https://www.abp.nl/english/financial-situation/financial-dashboard.aspx

- ↑ ABP. Financial situation on February 28th 2022, retrieved on April 6th 2022. https://www.abp.nl/english/financial-situation/financial-dashboard.aspx

- ↑ ABP. Persbericht: ABP krijgt een nieuw bestuurmodel, retrieved on April 7th 2022. https://www.abp.nl/over-abp/actueel/nieuws/abp-krijgt-een-nieuw-bestuursmodel%20.aspx

- ↑ ABP. Bestuur, retrieved on April 7th 2022. https://www.abp.nl/over-abp/onze-organisatie/bestuur/

- ↑ Heerlen Vertelt. Pioniers uit Den Haag: samen met het ABP verhuizen naar Heerlen, retrieved on April 7th 2022. https://www.heerlenvertelt.nl/2021/05/pioniers-uit-den-haag-samen-met-het-abp-verhuizen-naar-heerlen/

- ↑ ABP Annual Report 2020, p. 203, retrieved on April 7th 2022. https://jaarverslag.abp.nl/abp-jaarverslag-2020.pdf

- ↑ Martine Wolzak. Pensioenfonds ABP gooit zijn bestuur om, Snel weg, retrieved on April 7th 2022. https://fd.nl/economie-politiek/1389091/pensioenfonds-abp-gooit-zijn-bestuur-om

- ↑ ABP. Position Paper September 2019, p. 3, retrieved on April 7th 2022. https://www.abp.nl/images/Position-Paper-beloningsbeleid-september-2019.pdf

- ↑ APG Annual Report 2021, p. 127, retrieved on April 7th 2022. https://jaarverslag.apg.nl/docs/APG_JV_2021/pdfs/APG_Groep_NV_Jaarverslag_2021.pdf

- ↑ ABP Annual Report 2020, p. 207, retrieved on April 7th 2022. https://jaarverslag.abp.nl/abp-jaarverslag-2020.pdf

- ↑ ABP Annual Report 2015, p. 24, retrieved on April 7th 2022. https://www.abp.nl/images/jaarverslag-2015.pdf

- ↑ Pension Federatie. The Dutch pension system: highlights and characteristics, retrieved on April 8th, 2022. https://www.pensioenfederatie.nl/website/the-dutch-pension-system-highlights-and-characteristics#:~:text=Pension%20funds%20operate%20on%20the,collective%20investment%20of%20these%20contributions.

- ↑ ABP. Financial situation on February 28th 2022, retrieved on April 6th 2022. https://www.abp.nl/english/financial-situation/financial-dashboard.aspx

- ↑ ABP Annual Report 2020, p. 217, retrieved on April 8th 2022. https://view.publitas.com/cfreport/abp-annual-report-2020/page/217

- ↑ ABP Annual Report 2020, p. 218, retrieved on April 8th 2022. https://view.publitas.com/cfreport/abp-annual-report-2020/page/217

- ↑ ABP. Overview corporate bonds ABP, retrieved on April 8th 2022. https://www.abp.nl/images/overview-corporate-bonds.pdf

- ↑ Political Economy Research Institute, Toxic 100 Air Polluters Index (2021 Report, Based on 2019 Data), retrieved on April 8th 2022. https://peri.umass.edu/toxic-100-air-polluters-index-current

- ↑ Based on author’s own calculations using the overview corporate bonds ABP sheet. https://www.abp.nl/images/overview-corporate-bonds.pdf

- ↑ II May 1996 Archive. Can ABP Cope With Freedom?, retrieved on April 6th 2022. https://www.institutionalinvestor.com/article/b14zpmqlqfsjrm/from-the-archive-can-abp-cope-with-freedom-may-1996

- ↑ ABP Annual Report 2020, p. 64, retrieved on April 8th 2022. https://view.publitas.com/cfreport/abp-annual-report-2020/page/217

- ↑ Kennisbank ABPpensioen. De positie van pensioenfonds ABP https://abppensioen.nl/het-fundament-van-pensioenfonds-abp/#:~:text=De%20ABP%2Dpensioenregeling%20is%20(grond,materi%C3%ABle%20zin%20moet%20zijn%20verankerd.

- ↑ Martine Wolzak. Pensioenfonds ABP gooit zijn bestuur om, Snel weg, published on July 7th 2021, and accessed on April 12th 2022. https://fd.nl/economie-politiek/1389091/pensioenfonds-abp-gooit-zijn-bestuur-om

- ↑ ABP. Meten en sturen op de CO2-voetafdruk van onze beleggingen, p. 4, retrieved on April 12th 2022, https://www.abp.nl/images/ABP%20CO2%20methodologie_3.pdf

- ↑ APG. Verslag verantwoord beleggen APG groep 2020, p. 64, retrieved on April 12th 2022, https://apg.nl/media/dpef3e2e/nl-verslag-verantwoord-beleggen-apg-2020.pdf

- ↑ ABP. Sustainable and Responsible Investment 2015, p. 2, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2015.pdf

- ↑ ABP. Sustainable and Responsible Investment 2015, p. 4, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2015.pdf

- ↑ ABP. Sustainable and Responsible Investment 2019, p. 32, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP. Sustainable and Responsible Investment 2015, p. 26, retrieved on April 12th 2022. https://www.abp.nl/images/abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP. Sustainable and Responsible Investment 2019, p. 26, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP. Sustainable and Responsible Investment 2019, p. 27, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ Peer de Rijk. Nuclear energy? Too costly and too late, published on May 12th 2021 (accessed on April 12th 2022). https://spectator.clingendael.org/nl/publicatie/nuclear-energy-too-costly-and-too-late

- ↑ ABP. Sustainable and Responsible Investment 2019, p. 21, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP.Sustainable and Responsible Investment 2019, p. 23, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP. Sustainable and Responsible Investment Report 2019, p. 24, retrieved on April 12th 2022. https://www.abp.nl/images/abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP. ABP’s Sustainable and Responsible Investment Policy (2020-2025), retrieved on April 12th 2022. summary-sustainable-and-responsible-investment-policy.pdf (abp.nl)

- ↑ ABP. Duurzaam en verantwoord beleggingsbeleid ABP vanaf 2020: inzetten op duurzame en rechtvaardige transities, retrieved on April 14th 2022. "Concrete climate goals for 2030 will follow in 2022 as per the Climate Commitment of the Dutch financial sector", https://www.abp.nl/images/dvb-beleid-abp.pdf

- ↑ Gina Gambetta, CA100+ benchmark reveals 'painful' progress on climate as investors turn attention to pay, accounting, Just Transition, retrieved on April 7th 2022. https://www.responsible-investor.com/ca100-benchmark-reveals-painful-progress-on-climate-as-investors-turn-attention-to-pay-accounting-just-transition/

- ↑ ABP. ABP stopt met beleggen in producenten fossiele brandstoffen: feiten & cijfers, retrieved on April 14th 2022, https://www.abp.nl/images/abp-feiten-en-cijfers-dvb-november-2021.pdf

- ↑ ABP.Factsheet beleggen in steenkoolbedrijven, retrieved on April 14th 2022, https://www.abp.nl/images/ABP%20Factsheet%20beleggen%20in%20steenkoolbedrijven.pdf