Difference between revisions of "Stichting Pensioenfonds ABP"

AidenCorreia (talk | contribs) |

AidenCorreia (talk | contribs) |

||

| Line 161: | Line 161: | ||

=== Government === | === Government === | ||

ABP has been privatized since 1996, which means that the government is no longer in charge of how the pension fund invests its money. Prior to its privatization, ABP’s investment freedom was curtailed by the Dutch government. For instance, they were not allowed to engage in foreign investment. Nor could they own more than five percent of any one company. Additionally, they had to invest all government contributions in government debt.<ref>II May 1996 Archive. <i>Can ABP Cope With Freedom?</i>, retrieved on April 6th 2022. https://www.institutionalinvestor.com/article/b14zpmqlqfsjrm/from-the-archive-can-abp-cope-with-freedom-may-1996 </ref> | ABP has been privatized since 1996, which means that the government is no longer in charge of how the pension fund invests its money. Prior to its privatization, ABP’s investment freedom was curtailed by the Dutch government. For instance, they were not allowed to engage in foreign investment. Nor could they own more than five percent of any one company. Additionally, they had to invest all government contributions in government debt.<ref>II May 1996 Archive. <i>Can ABP Cope With Freedom?</i>, retrieved on April 6th 2022. https://www.institutionalinvestor.com/article/b14zpmqlqfsjrm/from-the-archive-can-abp-cope-with-freedom-may-1996 </ref> | ||

| Line 204: | Line 203: | ||

On September 1st, 2021, D66-politician and former secretary of state for Finance Menno Snel officially resigned as a board member of ABP. He did this after coming under fire from taking on an chairman position at Nogepa, the Dutch trade association of oil and gas exploration and production. According to critics from for instance protest group Fossielvrij NL (Fossil free Netherlands), this additional role would clash interests with his job at pension fund ABP.<ref>Jorn Jonker. <i>Felle kritiek op Menno Snel om nieuwe functie bij olie- en gasindustrie</i>, published on May 28th, 2021, accessed on April 13th 2022</ref> Opposition feared that Menno Snel being personally affiliated to the oil and gas industry would incentivize him to continue investing in the fossil industry, despite its ecological harmful implications. After resigning from ABP, Snel continued to work at Nogepa.<ref>Martine Wolzak. <i>Pensioenfonds ABP gooit zijn bestuur om, Snel weg</i>, published on July 7th 2021, and accessed on April 12th 2022. https://fd.nl/economie-politiek/1389091/pensioenfonds-abp-gooit-zijn-bestuur-om</ref> | On September 1st, 2021, D66-politician and former secretary of state for Finance Menno Snel officially resigned as a board member of ABP. He did this after coming under fire from taking on an chairman position at Nogepa, the Dutch trade association of oil and gas exploration and production. According to critics from for instance protest group Fossielvrij NL (Fossil free Netherlands), this additional role would clash interests with his job at pension fund ABP.<ref>Jorn Jonker. <i>Felle kritiek op Menno Snel om nieuwe functie bij olie- en gasindustrie</i>, published on May 28th, 2021, accessed on April 13th 2022</ref> Opposition feared that Menno Snel being personally affiliated to the oil and gas industry would incentivize him to continue investing in the fossil industry, despite its ecological harmful implications. After resigning from ABP, Snel continued to work at Nogepa.<ref>Martine Wolzak. <i>Pensioenfonds ABP gooit zijn bestuur om, Snel weg</i>, published on July 7th 2021, and accessed on April 12th 2022. https://fd.nl/economie-politiek/1389091/pensioenfonds-abp-gooit-zijn-bestuur-om</ref> | ||

=====Voter behavior at shareholder meetings ===== | |||

As a stakeholder of multiple corporations, ABP can exercise its influence with voting behavior in shareholder-meetings. Interestingly, and contrarily to their supposed intentions, ABP has repeatedly voted against propositions by companies to bring their policies in line with the Paris Climate Agreement. For instance, on March 17th 2022 ABP voted against Ole Schultz' proposition for Danske Bank to prepare a business strategy that follows the Paris Agreement's target of keeping global warning below 1.5 degrees Celsius. They voted similarly for the Bank of Nova Scotia, the Royal Bank of Canada, the Bank of Montreal and the Toronto-Dominion Bank. | |||

Starting April 26th however, ABP began voting more in line with their own intentions and green policy. However, this does not undo their past voting behavior. Additionally, the shareholder meetings last until May-June so it remains to be seen what the rest of their voting behavior will be.<ref>Utrecht Fossielvrij (@Fossielvrij030). ''Twitter thread: Pensioenfonds ABP heeft goede voornemens. Laten we eens kijken wat daar in de praktijk van terecht komt.'' Accessed on May 4th 2022.https://twitter.com/Fossielvrij030/status/1521133597415342081?s=20&t=k70l__jKAVrFfzSd5De2lA</ref> | |||

== Current Emissions == | == Current Emissions == | ||

Revision as of 16:08, 4 May 2022

| Stichting Pensioenfonds ABP | |

|---|---|

| |

| Quick Facts | |

| Type | Public sector pension fund |

| sector | Financial Services |

| Headquarters (Benelux Organization) | Heerlen, The Netherlands |

| Year of Origin | 1922 |

| Reported emissions | 21.35 million tonnes of CO2 (2020)[1] |

| Available assets | EUR€ 528 billion (2020)[2] |

| Stock Exchange | None |

| Key People | Harmen van Wijnen (Chairman Executive Board), Yolanda Verdonk-van Lokven (Executive Board Member); Dominique Dijkhuis (Executive Board Member) |

| Number of Employees | 41 (in 2020) |

| Subsidiaries | Algemene Pensioen Groep (APG)

|

Stichting Algemeen Burgerlijk Pensioen, stylized as Pensioenfonds ABP, is the biggest pension fund in the Netherlands, and among the largest worldwide.[3] Its headquarters are situated in Heerlen, a city in the Dutch province of Limburg.[4] ABP offers all types of pensions, such as a Disability Pension, a Partner's Pension, and a Retirement Pension. The pension fund was established in 1922, primarily to regulate the pensions of Dutch civil servants and teachers. At the time it was government controlled, but in 1996, ABP was privatized.[5] In 2020, the fund served over 3.1 million employees, and an additional 3,557 employers. The pension fund itself only had 41 employers as of 2020,[6] but its executive subsidiary Algemeen Pensioen Groep NV (APG) has over 3,124 employers in the Netherlands and another 246 abroad.[7] Although ABP predominantly provides pensions to Dutch citizens, the company invests worldwide.[8] At February 28th, 2022, ABP's current assets were worth €528 billion.[9] Their liabilities accounted for €475 billion.[10]

Company Structure

ABP's management model consists of three executive members, twelve non-executive members, and one independent chairperson.[11] The executive members are responsible for the daily management, such as decision making and implementation. The non-executive members have a supervisory role. They are appointed by employees, employer-organizations or retirees. The board is led by an independent chairman.[12]

ABP's headquarter are in Heerlen, the Netherlands.

Furthermore, ABP has outsourced the pension administration and management of invested capital to de Algemene Pensioen Groep (APG). In collaboration with Cordares, APG is responsible for for providing pension funds to individuals employed in the sectors education, government, construction, social work, medical specialists, architectural bureaus and social housing. In 2020, APG managed a total of €573 billion worth of assets.[13]

Executive Board

| Name | Function | Remuneration x1000 EUR |

|---|---|---|

| Harmen van Wijnen | Chairman Executive Board | 130,637 (2020)[14] |

| Yolanda Verdonk | Executive Board member | Unknown |

| Dominique Dijkhuis | Executive Board member | Unknown |

According to the 2020 annual report, this is what chairman H. Wijnen would make from May first, 2020 onwards. However, there is no telling what the remunerations are for the other board members, as they have only recently been appointed (Y. Verdonk in 02/2022 and D. Dijkhuis in 01/2022). Most likely, the salaries will not be able to be higher than €200,000 due to the Wet Normering Topinkomens (The Top Income Standard Law).[15]

ABP does state in a 2019 position paper that they strive to keep the managament wages in line with the wages received by their clients.[16] This means that the salaries will grow at the same rate as those of teachers and civil servants. However, ABP does grant performance bonuses to its directors. In addition to that, it allows its subsidiary APG to pay out high bonuses to those employed in the asset management department, spending more than 31.5 million EUR on bonuses alone.[17] On top of that, wages amongst those working at APG are significantly higher. In 2020 Annette Mosman (CEO) made €520,070, and Ronald Wuijster (head of the APG Asset Management) made €748,865.[18]

Supervisory Board

| Name | Function | Remuneration x1000 EUR (2020)[19] |

|---|---|---|

| Corien M. Wortmann-Kool | Chair Supervisory board | 130 |

| Aldert Boonen | Member supervisory board | Unknown |

| Patrick Fey | Member supervisory board | 90 |

| Anne Gram | Member supervisory board | Unknown |

| André van Vliet | Member supervisory board | 95,75 |

| Krista Nauta | Member supervisory board | 90 |

| Paul Rosenmöller | Member supervisory board | Unknown |

| Loek Sibbing | Member supervisory board | 90 |

| Vandena van der Meer-Gangapersadsing | Member supervisory board | Unknown |

| Conchita Mulder-Volkers | Member supervisory board | 90 |

| Xander den Uyl | Member supervisory board | 90 |

The reason the salaries and additional benefits of some of the supervisory board members are unknown, is because they did not begin working at ABP until or after 2021.

Accountant

The independent auditor of Pensioenfonds ABP is KPMG Advisory N.V. They have been ABP's accountant since January 1st, 2016.[20]

Main Activities

As ABP is a pension fund, it functions on the basis of capital funding. This entails that an employee, alongside their employer, accrues pension entitlements. These are put into a pension fund (in this case ABP) who then invests these contributions into different establishments, companies, and stocks. Over time, the pension fund increases the amount of capital they initially started out with, so that by the time someone goes into retirement, the pension they receive is more than what they deposited as pension entitlements. In the Netherlands, the pension system features “collectivity, mandatory participation, efficient administration and [it] is not-for-profit".[21] Because of this, it is beneficial for clients that ABP manages to expand their capital over the years and invests wisely. This especially since over 3.1 million Dutch citizens are affiliated to ABP.

At the start of 2022, their expected liabilities were €475 billion; this is the value of the pensions which ABP must pay out now and in the future. Meanwhile, their available assets (investment endeavors) were worth €528 billion. This means that, were every Dutch civil servant and teacher to suddenly retire, ABP would have the sufficient funds to cover all of the pensions, and then they would have an additional €53 billion left. At the time, their coverage ratio was 111.0%.[22]

ABP has a diversified investment portfolio. At the end of 2021, they had invested a total of €551,614 million in thirteen types of categories. These range from basic materials, to energy, to financial institutions. ABP invests most in other financial institutions (€138,171 million - 25.04%), public authorities (€129,388 million - 23.46%), and information technology (€59,159 million - 10.72%).[23] They invested slightly more than €16 billion in the energy sector. ABP invests worldwide, but predominantly seems to focus on North America (€207,445 million - 37.61%) and the European Monetary Union (€189,280 million - 34.31%).[24]

According to their overview of the holdings of ABP as per December 31st 2021, ABP has invested in some 867 companies worldwide.[25] 35 of these are amongst the top 100 most polluting companies worldwide.[26] In total, they invested about €1,499 million in these 35 companies alone.[27]

Government

ABP has been privatized since 1996, which means that the government is no longer in charge of how the pension fund invests its money. Prior to its privatization, ABP’s investment freedom was curtailed by the Dutch government. For instance, they were not allowed to engage in foreign investment. Nor could they own more than five percent of any one company. Additionally, they had to invest all government contributions in government debt.[28]

These restrictions have since been lifted, and ABP is free to invest wherever they like. They do continue to invest a lot in government bonds.[29]

ABP has not received any government-implemented COVID-19 support such as Temporary Emergency Bridging Measure for Sustained Employment (NOW) support. It has however invested a total of €927 million in governmental corona obligations.[30] Nor has ABP attained a royal status. However, it is in the government’s interest that ABP acts in the common interest of the public. This because the accrual of ABP’s pension fund is tax-facilitated, which results in less tax money flowing into the governmental treasury. Thus, Pensioenfonds ABP has to act with integrity, efficiently, trustworthiness, and transparency.[31]

Paris Agreement until Today

Pensioenfonds ABP strives to have their investment portfolio in line with the Paris Climate Agreement. Hence, they aim to contribute to a future where the world economy is climate neutral by 2050, and that global warming is limited to maximum 1.5⁰C.

Financial Results since 2015

| Year | Asset value |

|---|---|

| 2015 | €396,673 billion[32] |

| 2016 | €422,310 billion[33] |

| 2017 | €454,599 billion[34] |

| 2018 | €451,691 billion[35] |

| 2019 | €531,473 billion[36] |

| 2020 | €574,050 billion[37] |

Scandals and controversies

Menno Snel

On September 1st, 2021, D66-politician and former secretary of state for Finance Menno Snel officially resigned as a board member of ABP. He did this after coming under fire from taking on an chairman position at Nogepa, the Dutch trade association of oil and gas exploration and production. According to critics from for instance protest group Fossielvrij NL (Fossil free Netherlands), this additional role would clash interests with his job at pension fund ABP.[38] Opposition feared that Menno Snel being personally affiliated to the oil and gas industry would incentivize him to continue investing in the fossil industry, despite its ecological harmful implications. After resigning from ABP, Snel continued to work at Nogepa.[39]

As a stakeholder of multiple corporations, ABP can exercise its influence with voting behavior in shareholder-meetings. Interestingly, and contrarily to their supposed intentions, ABP has repeatedly voted against propositions by companies to bring their policies in line with the Paris Climate Agreement. For instance, on March 17th 2022 ABP voted against Ole Schultz' proposition for Danske Bank to prepare a business strategy that follows the Paris Agreement's target of keeping global warning below 1.5 degrees Celsius. They voted similarly for the Bank of Nova Scotia, the Royal Bank of Canada, the Bank of Montreal and the Toronto-Dominion Bank.

Starting April 26th however, ABP began voting more in line with their own intentions and green policy. However, this does not undo their past voting behavior. Additionally, the shareholder meetings last until May-June so it remains to be seen what the rest of their voting behavior will be.[40]

Current Emissions

According to ABP itself, the CO2-emmissions from all of their investments account to 21,355,163 CO2e in total. When looking at their assets, state obligations and private equity, ABP exclusively takes scope 1 and scope 2 into consideration. The only sector for which they look into scope 3 is the real estate market.

- Scope 1: direct emissions from company-owned and controlled resources. These are released into the atmosphere as a direct result of a set of activities;

- Scope 2: indirect emissions from the generation of purchased energy, such as electricity, steam, heat and cooling, from a utility provided;

- Scope 3: indirect emissions that occur in the value chain of the reporting company. These emissions are linked to the company's operations.[41]

The reason behind this informational gap is that according to them "data on scope 3 emissions are not trustworthy enough yet and it would lead to double counting".[42] Because they retrieve their data from independent instances, such as GRESB for the real estate market, ABP is unable to provide specificities on the amount of scope 3 emissions in this sector.

When looking at data provided by APG, ABP's subsidiary, the rate of CO2-emissions seems to be slightly higher. This is logical, given APG also manages assets for other pension funds such as BpfBouw. They report a total of 24,852,626 CO2e.[43]

| ABP (scope 1, 2, and 3*) | APG (scope 1, 2, and 3*) |

|---|---|

| 21.36 Megaton CO2 | 24.85 Megaton CO2 |

The only sector for which scope 3 is accounted is the real estate market. As a result, this leaves out a lot of data with regard to the total amount of emissions.*

Climate Policy and Plans

2015 to 2020

In response to the Paris Climate Agreement, ABP published a Sustainable and Responsible Investment 2015 report. Here they argued that they would strive to become a sustainable pension fund. Building onto the idea that “returns and sustainability go hand in hand,”[44] ABP pledged to focus on responsible investments. In collaboration with their investment organization APG they strived to solely invest in companies setting good examples, and exert their influence on incentivizing companies to improve.

Some of the clear goals they set themselves were to i) cut their CO2 footprint of their equities portfolio by 25% between 2016 and 2020; ii) increase their investment in renewable energy to €5 billion; iii) double their investment in solutions to social and environmental problems to €58 billion by 2020; and lastly iv) invest an additional €1 billion by 2020 in their participants’ areas of involvement: education and communications infrastructure.[45] They gave themselves until 2020 to introduce these new policies.

By the end of 2020, ABP had reduced the CO2 footprint of its equity portfolio by 44 percent compared to 2014.[46] However, important to take into consideration here is the effect that the COVID-19 pandemic had on polluting sectors such as energy and industry. As a response, ABP’s portfolio managers naturally invested less in these sectors, hence sharply reducing their CO2 footprint. It is unclear if the portfolio managers would have made the same choices if it had not been for the economic turmoil following the COVID-19 outbreak.

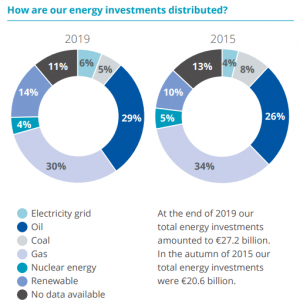

ABP did increase their investment in renewable energy with a total of €6.5 billion.[48] Part of this money has gone to Merkur Offshore, a large wind farm situated in the German sector of the North Sea. ABP states that these wind turbines save around 480,000 metric tons of CO2 emissions. They have also invested in the Dutch wind farm Goeree-Overflakkee.[49] They do however continue to invest in energy company Engie whose subsidiary owns nuclear power plants. According to the opposition, nuclear energy is costly, inefficient, too slow, and potentially dangerous.[50] Although ABP has begun to invest more in renewable energy, they did continue to invest relatively more in gas and oil (Image 1).

ABP has managed to double their investment in solutions to social and environmental problems. In total, the pension fund has invested 65.6 billion in companies that contribute to the Sustainable Development Goals (SDGs).[51] These companies are referred to as Sustainable Development Investments (SDIs). These companies must meet ABP’s criteria for return, risk and costs. The largest share of the SDIs is real estate. A total of €24 billion has been invested in sustainable real estate to meet the demands of SDG 11 - Sustainable cities and communities. These companies qualify as an SDI if it receives either four of five out of five stars on the annual sustainability survey of the Global Real Estate Sustainability Benchmark (GRESB).[52] Additional to this, ABP has expanded its green bond portfolio and currently invests a total of €7,601 million in green bonds.[53]

2020 and beyond

At the end of 2020 they published a new Sustainable and Responsible Investment Policy (2020-2025).[54] With their policy, ABP addressed three major transitions in the coming year. These are

- Addressing climate change and the need to transition to new energy generation and renewable energy sources;

- Conservation of natural sources, including increasing scarcity of raw materials and food;

- The digitalization of society, in which technology plays an increasingly important role.[55]

More concretely, by 2025 ABP strives to have:

- 20% of their total assets under management to go to investments that are qualified as Sustainable Development Investments (SDIs);

- Reduced the CO2-emissions of their equity portfolio by 2025 (relative to 2015);

- Phased out their investments in coal mines and tar sands (under certain turnover conditions);

- Created a more stringent climate criteria in their inclusion policy;

- Invested an additional EUR 15 billion in renewable and affordable energy by 2025;

- Contributed more to CA100+;

- Published climate targets for 2030 in line with expectations in the Dutch Climate Agreement by 2022;

- Invested more in companies with circular business models;

- Amongst others goals. The rest of the goals can be read in their Sustainability and Responsible Investment Policy.

In October 2021, ABP announced it will stop investing in fossil fuel producers.[56] On top of that, ABP will also sell all of their assets in coal producers.[57] They hope to have sold the majority of these by 2023.

ABP is also a member of Climate Action 100+ (CA100+), an investor-led collaboration that attempts to pressure companies in reducing their CO2 levels by rewarding them financially. Despite good intentions, CA100+ has as of now failed to push 158 of its focus companies forward.[58] More specifically, according to the Carbon Tracker Institute, none of the CA100+ focus companies within upstream oil & gas production or coal & gas-powdered electricity generation have capital allocation plans aligned with the Paris Agreement.[59]

Response to Milieudefensie's campaign

In response to Milieudefensie's request to provide a more concrete plan on how to drastically lower C02-emissions, ABP argues to have refined their policy plans. They state that they will set themselves a new goal with regard to lowering CO2-emissions of their assets. They will publish these plans later this year.[60]

Due Diligence

Animal welfare

According to Funding destruction of the Amazon and the Cerrado-savannah (2020), ABP has invested nearly 580 million EUR in companies which are either directly or indirectly connected to deforestation in the Brazilian Amazon and the Cerrado-savannah.[61] The majority of their spending went to the China Mengnui Dairy group, who in 2008 went viral over a scandal regarding their deteriorated quality of milk and their mistreatment regarding dairy farmers.[62] The second largest beneficiary of investments provided by ABP was Brazilian meat producer JBS. JBS has been under fire for multiple scandels, such as bribing more than 1,000 politicians, modern-day "slave labor" practices, illegal deforestation, animal welfare violations and mayor hygiene breaches.[63]

ABP scored low on the four assessment pillars for the policy assessments of Dutch pension funds. They marked a 2.5 regarding forest and biodiversity perseverance, a 5.2 regarding human rights, 0.0 points when it came to animal welfare, and then a 6.4 on transparency and accountability.[64]

Human rights

According to Pension funds and land grab - an inconvenient truth (2021), ABP appears to have invested 3.7 billion EUR in 22 companies that are involved in land rights violations.[65] These companies include American Exxon Mobil Corp, in which a total of 381 million EUR has been invested, and Pepsico Inc, which received a total of 715 million EUR.[66]

Out of all Dutch pension funds, ABP is the one to invest the most amount of money in these destructive companies. Some examples of the actions taken by these 22 companies are i) French-based oil producer Total displaced local communities in order to build a new pipeline; ii) Australian Rio Tito bombed two old and sacramental caves in order to expand their mine production; iii) Brazilian iron producer Vale disregarded work safety standards resulting in the deaths of 250 people.[67]

Climate change

According to Fossil fuel versus renewable financing by financial institutions active in the Netherlands (2021) ABP was by far and large one of the biggest investors in fossil energy.[68] At the end of 2020, ABP had invested a total of 8,558 million EUR in the energy industry. 86% of that money went to fossil fuels, whilst the rest (14%) went to renewables.[69] Important to mention here is that on the day this report was published, ABP announced its phase out of investments in fossil fuel producers.

Conclusion

Recap of the position and influence of the company. Are the climate plans of the company enough to be in line with goals of the Paris Agreement? Is the company doing enough? Are the companies targets realistic?

References

- ↑ ABP. Meten en sturen op de CO2-voetafdruk van onze beleggingen, p. 2, retrieved on April 12th 2022. https://www.abp.nl/images/ABP%20CO2%20methodologie_3.pdf

- ↑ ABP. Financial situation on February 28th 2022, retrieved on April 6th 2022. https://www.abp.nl/english/financial-situation/financial-dashboard.aspx

- ↑ Kennisbank ABPpensioen. De positie van pensioenfonds ABP, retrieved on April 6th 2022. https://abppensioen.nl/het-fundament-van-pensioenfonds-abp/

- ↑ ABP. Contact Us, retrieved on April 6th 2022. https://www.abp.nl/english/contact-us.aspx

- ↑ II May 1996 Archive. Can ABP Cope With Freedom?, retrieved on April 6th 2022. https://www.institutionalinvestor.com/article/b14zpmqlqfsjrm/from-the-archive-can-abp-cope-with-freedom-may-1996

- ↑ ABP Annual Report 2020, p. 5, retrieved on April 6th 2022. https://jaarverslag.abp.nl/abp-jaarverslag-2020.pdf

- ↑ APG Annual Report 2021, p. 125, retrieved on April 6th 2022. https://jaarverslag.apg.nl/docs/APG_JV_2021/pdfs/APG_Groep_NV_Jaarverslag_2021.pdf

- ↑ ABP. Overview Corporate Bonds ABP as per December 31, 2021, retrieved on April 6th 2022. https://www.abp.nl/images/overview-corporate-bonds.pdf

- ↑ ABP. Financial situation on February 28th 2022, retrieved on April 6th 2022. https://www.abp.nl/english/financial-situation/financial-dashboard.aspx

- ↑ ABP. Financial situation on February 28th 2022, retrieved on April 6th 2022. https://www.abp.nl/english/financial-situation/financial-dashboard.aspx

- ↑ ABP. Persbericht: ABP krijgt een nieuw bestuurmodel, retrieved on April 7th 2022. https://www.abp.nl/over-abp/actueel/nieuws/abp-krijgt-een-nieuw-bestuursmodel%20.aspx

- ↑ ABP. Bestuur, retrieved on April 7th 2022. https://www.abp.nl/over-abp/onze-organisatie/bestuur/

- ↑ APG. APG Group Annual report 2020, p. 33, retrieved on May 4th 2022. https://apg.nl/media/kosb0sf4/apg_group_nv_annual_report_2020.pdf

- ↑ ABP Annual Report 2020, p. 203, retrieved on April 7th 2022. https://jaarverslag.abp.nl/abp-jaarverslag-2020.pdf

- ↑ Martine Wolzak. Pensioenfonds ABP gooit zijn bestuur om, Snel weg, retrieved on April 7th 2022. https://fd.nl/economie-politiek/1389091/pensioenfonds-abp-gooit-zijn-bestuur-om

- ↑ ABP. Position Paper September 2019, p. 3, retrieved on April 7th 2022. https://www.abp.nl/images/Position-Paper-beloningsbeleid-september-2019.pdf

- ↑ Frank van Alphen. APG pays out most of its bonuses to its overseas staff. IPE. Published on May 15th 2017 and accessed on May 4th 2022. https://www.ipe.com/apg-pays-most-of-its-bonuses-to-its-overseas-staff/10018949.article

- ↑ APG Annual Report 2021, p. 127, retrieved on April 7th 2022. https://jaarverslag.apg.nl/docs/APG_JV_2021/pdfs/APG_Groep_NV_Jaarverslag_2021.pdf

- ↑ ABP Annual Report 2020, p. 207, retrieved on April 7th 2022. https://jaarverslag.abp.nl/abp-jaarverslag-2020.pdf

- ↑ ABP Annual Report 2015, p. 24, retrieved on April 7th 2022. https://www.abp.nl/images/jaarverslag-2015.pdf

- ↑ Pension Federatie. The Dutch pension system: highlights and characteristics, retrieved on April 8th, 2022. https://www.pensioenfederatie.nl/website/the-dutch-pension-system-highlights-and-characteristics#:~:text=Pension%20funds%20operate%20on%20the,collective%20investment%20of%20these%20contributions.

- ↑ ABP. Financial situation on February 28th 2022, retrieved on April 6th 2022. https://www.abp.nl/english/financial-situation/financial-dashboard.aspx

- ↑ ABP Annual Report 2020, p. 217, retrieved on April 8th 2022. https://view.publitas.com/cfreport/abp-annual-report-2020/page/217

- ↑ ABP Annual Report 2020, p. 218, retrieved on April 8th 2022. https://view.publitas.com/cfreport/abp-annual-report-2020/page/217

- ↑ ABP. Overview corporate bonds ABP, retrieved on April 8th 2022. https://www.abp.nl/images/overview-corporate-bonds.pdf

- ↑ Political Economy Research Institute, Toxic 100 Air Polluters Index (2021 Report, Based on 2019 Data), retrieved on April 8th 2022. https://peri.umass.edu/toxic-100-air-polluters-index-current

- ↑ Based on author’s own calculations using the overview corporate bonds ABP sheet. https://www.abp.nl/images/overview-corporate-bonds.pdf

- ↑ II May 1996 Archive. Can ABP Cope With Freedom?, retrieved on April 6th 2022. https://www.institutionalinvestor.com/article/b14zpmqlqfsjrm/from-the-archive-can-abp-cope-with-freedom-may-1996

- ↑ ABP Annual Report 2020, p. 64, retrieved on April 8th 2022. https://view.publitas.com/cfreport/abp-annual-report-2020/page/217

- ↑ ABP. ABP Jaarverslag 2020, p. 74, retrieved on May 4th 2022. https://jaarverslag.abp.nl/abp-jaarverslag-2020.pdf

- ↑ Kennisbank ABPpensioen. De positie van pensioenfonds ABP https://abppensioen.nl/het-fundament-van-pensioenfonds-abp/#:~:text=De%20ABP%2Dpensioenregeling%20is%20(grond,materi%C3%ABle%20zin%20moet%20zijn%20verankerd.

- ↑ ABP. Jaarverslag 2015, p. 74, retrieved on April 13th 2022. https://www.abp.nl/images/jaarverslag-2015.pdf

- ↑ ABP. Jaarverslag 2016, p. 77, retrieved on April 13th 2022. https://www.abp.nl/images/jaarverslag-2016.pdf

- ↑ ABP. Jaarverslag 2017, p. 79, retrieved on April 13th 2022. https://www.abp.nl/images/jaarverslag-2017.pdf

- ↑ ABP. Jaarverslag 2018, p. 93, retrieved on April 13th 2022. https://www.abp.nl/images/ABP-jaarverslag-2018.pdf

- ↑ ABP. Jaarverslag 2019, p. 102, retrieved on April 13th 2022. https://www.abp.nl/images/ABP-jaarverslag.pdf

- ↑ ABP. Jaarverslag 2020, p. 143, retrieved on April 13th 2022. https://view.publitas.com/cfreport/abp-annual-report-2020/page/143

- ↑ Jorn Jonker. Felle kritiek op Menno Snel om nieuwe functie bij olie- en gasindustrie, published on May 28th, 2021, accessed on April 13th 2022

- ↑ Martine Wolzak. Pensioenfonds ABP gooit zijn bestuur om, Snel weg, published on July 7th 2021, and accessed on April 12th 2022. https://fd.nl/economie-politiek/1389091/pensioenfonds-abp-gooit-zijn-bestuur-om

- ↑ Utrecht Fossielvrij (@Fossielvrij030). Twitter thread: Pensioenfonds ABP heeft goede voornemens. Laten we eens kijken wat daar in de praktijk van terecht komt. Accessed on May 4th 2022.https://twitter.com/Fossielvrij030/status/1521133597415342081?s=20&t=k70l__jKAVrFfzSd5De2lA

- ↑ PlanA Academy. What are Scope 1, 2 and 3 of Carbon Emissions?, published on August 12 2020, and accessed on April 14th 2022. https://plana.earth/academy/what-are-scope-1-2-3-emissions/

- ↑ ABP. Meten en sturen op de CO2-voetafdruk van onze beleggingen, p. 4, retrieved on April 12th 2022, https://www.abp.nl/images/ABP%20CO2%20methodologie_3.pdf

- ↑ APG. Verslag verantwoord beleggen APG groep 2020, p. 64, retrieved on April 12th 2022, https://apg.nl/media/dpef3e2e/nl-verslag-verantwoord-beleggen-apg-2020.pdf

- ↑ ABP. Sustainable and Responsible Investment 2015, p. 2, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2015.pdf

- ↑ ABP. Sustainable and Responsible Investment 2015, p. 4, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2015.pdf

- ↑ ABP. Sustainable and Responsible Investment 2019, p. 32, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP. Sustainable and Responsible Investment 2015, p. 26, retrieved on April 12th 2022. https://www.abp.nl/images/abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP. Sustainable and Responsible Investment 2019, p. 26, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP. Sustainable and Responsible Investment 2019, p. 27, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ Peer de Rijk. Nuclear energy? Too costly and too late, published on May 12th 2021 (accessed on April 12th 2022). https://spectator.clingendael.org/nl/publicatie/nuclear-energy-too-costly-and-too-late

- ↑ ABP. Sustainable and Responsible Investment 2019, p. 21, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP.Sustainable and Responsible Investment 2019, p. 23, retrieved on April 12th 2022. abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP. Sustainable and Responsible Investment Report 2019, p. 24, retrieved on April 12th 2022. https://www.abp.nl/images/abp-sustainable-and-responsible-investment-report-2019.pdf

- ↑ ABP. ABP’s Sustainable and Responsible Investment Policy (2020-2025), retrieved on April 12th 2022. https://www.abp.nl/images/summary-sustainable-and-responsible-investment-policy.pdf

- ↑ ABP. ABP’s Sustainable and Responsible Investment Policy (2020-2025), p. 3, retrieved on April 12th 2022. https://www.abp.nl/images/summary-sustainable-and-responsible-investment-policy.pdf

- ↑ ABP. ABP stopt met beleggen in producenten fossiele brandstoffen: feiten & cijfers, retrieved on April 14th 2022, https://www.abp.nl/images/abp-feiten-en-cijfers-dvb-november-2021.pdf

- ↑ ABP.Factsheet beleggen in steenkoolbedrijven, retrieved on April 14th 2022, https://www.abp.nl/images/ABP%20Factsheet%20beleggen%20in%20steenkoolbedrijven.pdf

- ↑ Gina Gambetta, CA100+ benchmark reveals 'painful' progress on climate as investors turn attention to pay, accounting, Just Transition, retrieved on April 7th 2022. https://www.responsible-investor.com/ca100-benchmark-reveals-painful-progress-on-climate-as-investors-turn-attention-to-pay-accounting-just-transition/

- ↑ Henrik Jeppesen. CA100+ a long way from destination. Carbon Tracker Institute. Published on March 28th 2022, and accessed on May 4th 2022. https://carbontracker.org/ca100-a-long-way-from-destination/

- ↑ ABP. ABP licht klimaatbeleid aan Milieudefensie toe, published on April 13th 2022, and accessed on April 13th 2022, https://www.abp.nl/over-abp/actueel/nieuws/abp-licht-klimaatbeleid-aan-milieudefensie-toe.aspx?ns_mchannel=sm_twitter&ns_campaign=&ns_source=Help_Duurzaamheid_f_abp_vandaag&ns_linkname=&ns_fee=0

- ↑ Jan Willem van Gelder, Barbara Keupper, et al. Funding destruction of the Amazon and the Cerrado-savannah, p. 4, published on Augustus 27th 2020 and retrieved on April 13th 2022. https://fairfinanceguide.org/media/496089/funding-destruction-of-amazon-cerrado.pdf

- ↑ Tracy Dai. Yili and Mengniu milk scandal claim goes viral, published on July 28th 2020 and accessed on April 13th 2022.https://www.chinaskinny.com/blog/milk-scandal-china/

- ↑ Andrew Wasley, Alexandra Heal, Lucy Michaels, et al. JBS: The Brazilian butchers who took over the world, published on July 2nd 2019 and accessed on April 13th 2022. https://www.thebureauinvestigates.com/stories/2019-07-02/jbs-brazilian-butchers-took-over-the-world

- ↑ Jan Willem van Gelder, Barbara Keupper, et al. Funding destruction of the Amazon and the Cerrado-savannah, p. 73, published on Augustus 27th 2020 and retrieved on April 13th 2022. https://fairfinanceguide.org/media/496089/funding-destruction-of-amazon-cerrado.pdf

- ↑ Eerlijke Pensioenwijzer. Pension funds and land grab - an inconvenient truth, p. 4, published on February 25th 2021, and retrieved on April 13th 2022 https://eerlijkegeldwijzer.nl/media/496737/2021-02-praktijkonderzoek-pensioenfondsen-en-landrechten.pdf

- ↑ Eerlijke Pensioenwijzer. Pension funds and land grab - an inconvenient truth, appendix 4, published on February 25th 2021, and retrieved on April 13th 2022 https://eerlijkegeldwijzer.nl/media/496737/2021-02-praktijkonderzoek-pensioenfondsen-en-landrechten.pdf

- ↑ Eerlijke Pensioenwijzer. Pension funds and land grab - an inconvenient truth, p. 4, published on February 25th 2021, and retrieved on April 13th 2022 https://eerlijkegeldwijzer.nl/media/496737/2021-02-praktijkonderzoek-pensioenfondsen-en-landrechten.pdf

- ↑ Eerlijke Gelwijzer. Fossil fuel versus renewable financing by financial institutions active in the Netherlands, published on October 26 2021, and retrieved on April 13th 2022. https://eerlijkegeldwijzer.nl/media/497252/2021-10-praktijkonderzoek-fossiel-versus-duurzame-energie.pdf

- ↑ Eerlijke Gelwijzer. Fossil fuel versus renewable financing by financial institutions active in the Netherlands, p. 3, published on October 26 2021, and retrieved on April 13th 2022. https://eerlijkegeldwijzer.nl/media/497252/2021-10-praktijkonderzoek-fossiel-versus-duurzame-energie.pdf