Difference between revisions of "AholdDelhaize"

| Line 118: | Line 118: | ||

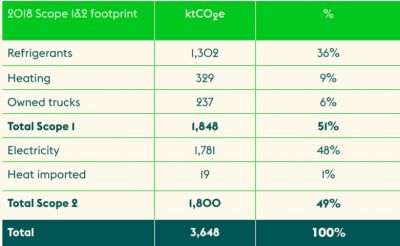

These are the emissions of their own operations. The biggest contributors here are electricity with 28% of total scope 1 and 2 emissions and refrigerators with 36%. | These are the emissions of their own operations. The biggest contributors here are electricity with 28% of total scope 1 and 2 emissions and refrigerators with 36%. | ||

[[File:Scope 1 & 2 Ahold Delhaize.jpg|400px|alt=Bedrijf Logo]] | |||

Scope 3: 70,800 Kton Co2 | Scope 3: 70,800 Kton Co2 | ||

Revision as of 17:10, 8 December 2021

Koninklijke Ahold Delhaize N.V, stylized as Ahold Delhaize, is a Dutch multinational company owning various brands active in the food and retail sector. It was founded in 2016 after Ahold and Delaize Group merged. The company is headquartered in Zaandam, the Netherlands, and is active in various European countries, the US and Indonesia. Since 2018 its CEO is Frans Muller. The company’s shares are listed on Euronext Amsterdam and Brussels and had a revenue of €74.7 billion in 2020.

Company Structure

Executive Committee

- Frans Muller (CEO)

- Natalie Knight

- Kevin Holt

- Wouter Kolk

- Ben Wishart

- Jan Ernst de Groot

Supervisory Board

- Peter Agnefjäll (chair)

- Bill McEwan

- René Hooft Graafland

- Helen Weir

- Katie Doyle

- Mary Anne Citrino

- Frank van Zanten

- Bala Subramanian

- Jan Zijderveld

Accountant

Accountant van het bedrijf

Operations

uitgebreidere beschrijving van het bedrijf en wat ze doen en of ze koninklijk zijn en NOW steun

Paris Agreement to Today

In November 2021 ClientEarth and the Plastic Soup Foundation filed a joint complaint against AholdDelhaize at the Autoriteit Financiële Markten (AFM) regarding transparency on the usage of plastic waste. The AFM is the Dutch authority supervising the behavior of participants in financial markets and falls under the supervision of the Dutch minister of finance, which at the time was Wobke Hoekstra. According to the environmental organizations AholdDelaize did reported insuficiantly on its plastic waist in their annual report, violating EU guidelines.

In November 2021 AholdDelhaize stated to strengthen their commitments and set the target to reduce the emissions of their own emissions to net zero by 2040. However, this would not include their scope 3 emissions which account for the vast majority of their total emissions.

In may 2021 AholdDelhaize, along with other companies, signed an open letter to the Brazilian government to stop legislation that would make deforestation for agriculture in Brazil (mostly soy) easier. However, according to a Greepeace study Albert Heijn nevertheless makes about 40 million euros of profit from Brazilian soy beans, while 22% of all Brazilian soy exported to Europe is the result of illegal deforestation according to a study in Science magazine.

Current Policies and Emissions

Scope 1 & 2: 3,648 Kton Co2 These are the emissions of their own operations. The biggest contributors here are electricity with 28% of total scope 1 and 2 emissions and refrigerators with 36%.

Scope 3: 70,800 Kton Co2 The scope 3 emissions are emissions from their value chain. By far the biggest portion of AholdDelhaize’s total emissions can be attributed to their scope 3 emissions. The biggest contribution in scope 3 comes from purchased goods and services, namely 90.77%.

-picture-

Climate Plans

In their sustainability report of 2020 AholdDelhaize put forward two key ambitions (https://www.aholddelhaize.com/en/sustainability/climate-impact/). First of all, they want to reduce absolute emissions from their own operations (scope 1 and 2) by 50% between 2018-2030. Secondly, they want to reduce absolute emissions from their value chain (scope 3) by 15% between 2018-2030. They also aim to be net zero (scope 1,2 and 3) in 2050 and remain under 1.5 degrees celcius as committed through their partnership with the Race To Zero trajectory of Science Based Targets initiative (SBTi).

Conclusion

Beschrijving of de plannen in lijn zijn met 'Parijs'

Bedrijfsspecifieke Passage in 'de brief'

SOWIESO

U heeft uw duurzaamheidsbeleid vastgelegd in [opsomming stukken].

INDIEN ER DOELEN ZIJN

Wij constateren dat uw ambitie is om [doelen van het bedrijf over alle emissies]. Het is duidelijk dat u daarmee 1 niet binnen een gezond pad van anderhalve graden blijft OF niet transparant/duidelijk/ of als deze ambitie gehaald wordt dat u daarmee binnen uw budget binnen een anderhalve graden scenario blijft.

INDIEN ER GEEN DOELEN ZIJN

Wij constateren dat u geen ambities heeft gesteld om de emissies uit uw hele waardeketen binnen de anderhalve graden te brengen.

INDIEN VAN TOEPASSING

In uw plannen blijkt niet goed u uw ambities gaat realiseren. Dat is een grote tekortkoming en dat maakt de ambitie niet geloofwaardig.

SOWIESO

Daarmee draagt uw bedrijf bij aan gevaarlijke klimaatverandering en loopt u het materiële risico om mensenrechtenschendingen te veroorzaken.